Contact

Provider(s):

You must log in in order to see contact information. If you don't have an account, you can ask for one on this form.

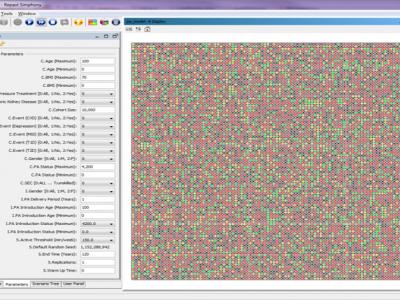

AIR models help to anticipate the drivers of mortality and morbidity risk to facilitate optimal risk management, risk transfer, and risk mitigation decisions that align with organisation's strategic goals.

Life and health insurers face a host of challenges—and opportunities—against a backdrop of market uncertainty, reduced mortality rates, and emerging infectious diseases. AIR models help you anticipate the drivers of mortality and morbidity to facilitate optimal management, risk transfer, and risk decisions that align with your strategic goals.

Website: https://www.air-worldwide.com/Models/Life-and-Health/

PDF Brochure: https://www.air-worldwide.com/Publications/Brochures/documents/AIR-Pandemic-Model/

Supported Use Cases

Risk Mitigation and Risk Transfer

Addressed hazards

Innovation stage

Readiness

Crisis Cycle Phase

Crisis size

Illustrations

|

Portfolio of Solutions web site has been initially developed in the scope of DRIVER+ project. Today, the service is managed by AIT Austrian Institute of Technology GmbH., for the benefit of the European Management. PoS is endorsed and supported by the Disaster Competence Network Austria (DCNA) as well as by the STAMINA and TeamAware H2020 projects. |